Collision insurance to cover damage to your own vehicle is a good idea but not required by law and this is considered additional coverage. Ad Protect Yourself Your Business With Tailored Insurance.

Who Can Drive My Car Under My Insurance In Ontario Isure Ca

We Help You Find The Right Car Insurance Policies At Affordable Prices.

. How Does Car Insurance Work. Public car insurance means that the company that provides the insurance for your car and everyone else in that province who buys car insurance is a government-owned corporation. Auto Insurance Risk and Auto Insurance Rules Vary by Province.

6 Symptoms of a Bad U Joint. Essentially no-fault insurance in Ontario is that in the event of an accident without or without collision coverage all drivers involved will process individual claims through their own insurance companies to get coverage for damages and injuries. Find out if youre overpaying on car insurance using our cost calculator.

Typical home insurance coverage The amount of coverage you need will be determined by factors such as the value of your home and contents the location and age of the home and the risk you pose to the insurer. Ad Compare Insurance Quotes For A Range Of Cover Types With Compare The Market. No-fault insurance also known as the Ontario Motorist Protection Plan is a system outlining how claims are handled by insurers and simplify the claims process for drivers involved in a collision.

If you are in an accident where you are deemed not-at-fault DCPD coverage means your insurer will pay for repairs without having to recover damages from the other driver. To begin Ontario operates with a no-fault insurance system. How does tenant insurance work in Ontario.

When it comes to renting there are two types of insurance coverage needed. Posted by autoview on 04 May 2022 1046 AM. You can go through an insurance broker who offers insurance products for various insurance companies.

Protection Against Compensation Claims For Injury Or Damage Because Of Your Business. With the public insurance system you may also have the option to increase your coverage with a privately-owned publicly traded or mutual insurance company. This data is traceable to different factors such as car insurance being.

Ontario operates through a no-fault insurance scheme. The type of insurance you need depends on whether youre an owner tenant or landlord. The higher the deductible you choose the lower your premium cost - you only pay this amount if you file an accident claim.

No-fault means drivers use their own insurance company regardless of who is at fault in an accident. Permanent life insurance is a policy that you maintain for the rest of your life unless you cancel the policy. If you are eligible to receive financial assistance through Ontario Works you will receive a monthly payment.

Facebook-f Twitter Youtube Medium. According to the Financial Services Regulatory Authority of Ontario FSRA which is the body that regulates insurance in Ontario you can be anywhere from zero to 100 per cent at-fault in an accident. In Ontario Quebec Nova Scotia New Brunswick and Prince Edward Island TPL contains a component called Direct Compensation - Property Damage DCPD.

If you are determined to be at-fault you will most likely see an increase in your insurance rates. Perhaps youre expanding your business launching a new bricks mortar location and wondering How does general liability insurance work in Canada Or maybe you are looking to start-up a new cannabis businessWhatever your new or growth plans entail understanding How does general liability insurance work in. It can cost anywhere from 100-1000 depending on the plan.

Insurance is a financial product sold by insurance companies to safeguard you and or your property against the risk of loss damage or theft such as flooding burglary or an accident. Its usually bought for estate. This helps to make sure you get the right coverage at the right price.

No-fault means that regardless of who is at fault for an accident each drivers insurer will handle their claim. Why Was No-Fault Introduced. Or you can go through an a certified insurance agent who works for a single insurance company and only sells that companys coverage.

Ontario law requires that all motorists have auto insurance. Last year Ontario drivers using RATESDOTCA paid on an average 30 less than the median market rate. Ontario auto insurance is provided by private insurance companies and is regulated by the Financial Services Regulatory Authority of Ontario FSRAO.

Learn about how your living situation affects the amounts you receive. Visit the Registered Insurance Brokers of Ontarios website for a list of licensed insurance brokers. As with standard automobile insurance you can choose the value.

Buy Online In Minutes. Common myths about at-fault insurance in Ontario. Most insurers offer a 500 deductible.

Ontarios average monthly car insurance cost is the second-highest in Canada with only British Columbia having a higher figure. In Ontario it is mandatory that you insure all your vehicles for third-party liability of at least 200000. The federal government via the Office of the Superintendant of Financial Institutions OSFI requires insurance companies to have a certain amount of capital on hand to cover every policy they sell.

Some types of insurance you have to take out by law such as motor insurance if you drive a vehicle. Health-related benefits See what help is available for health prescription drug eye exams and other benefits you and your family may be eligible for. Tenant insurance works similar to any other type of property insurance.

What Causes a Pinion Seal to Leak. The insurance company must prove that it can cover every potential claim they sell. Ontario insurance is a private industry that means the policy is purchased by a private company.

How Does General Liability Insurance Work In Canada. Some you may need as a condition of a contract such as buildings insurance as a. This covers you in the event that you injure or kill someone or damage someones property.

Save money by comparing quotes from over 30 of Canadas top insurance providers. The average annual car insurance in Ontario is about 1500 which is about 125 per month. April 25 2022.

Fines for vehicle owners lessees and drivers who do not carry valid auto insurance can range from 5000 to 50000. If you are found driving without valid auto insurance you can have your drivers licence suspended and your vehicle impounded.

Driving Without Insurance In Ontario Fines Penalties Laws

Average Car Insurance Cost In Ontario By Month Age Gender

Who Can Drive My Car Under My Insurance In Ontario Isure Ca

Auto Insurance Compare Car Insurance Quotes Ratehub Ca

What Is Non Owner Car Insurance In Ontario Isure Insurance Inc

Canadian Loss Experience Automobile Rating Clear

What Determines Your Auto Insurance Rate Financial Services Regulatory Authority Of Ontario

Average Car Insurance Cost In Ontario By Month Age Gender

Average Tenant Insurance Cost In Ontario

Did You Know Personal Health Insurance Premiums Are An Eligible Tax Deductible Expense In Ontario Ontario Blue Cross

Motorcycle Insurance Quotes Ontario Under 25 Quotes For College Students Insurance Quotes College Quotes

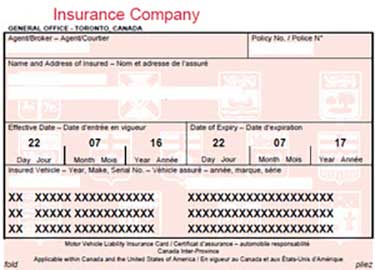

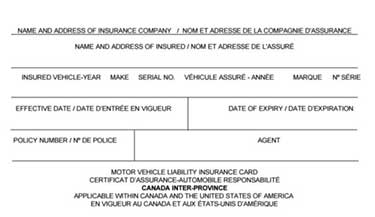

Proof Of Car Insurance In Ontario New Digital Pink Slips

Compare Ontario Car Insurance Quotes Online Ratehub Ca

Auto Insurance Ontario Homeowners Best Places To Work Study Plan Best Insurance

Why Is Ontario Greater Toronto Car Insurance So Expensive Car Insurance Shop Insurance Car Insurance Rates

Average Car Insurance Cost In Ontario By Month Age Gender

Long Term Disability In Ontario Simple Guide Dutton Employment Law

Post A Comment:

0 comments: